ORISSA HIGH COURT PERMITS THE RECTIFICATION OF FORM GSTR -1 AFTER THE LAST DATE OF CARRYING RECTIFICATION

M/s. Shiva Jyoti Construction vs The Chairperson, Central Board of Excise & Customs and others [TS-79-HC(ORI)-2023-GST]

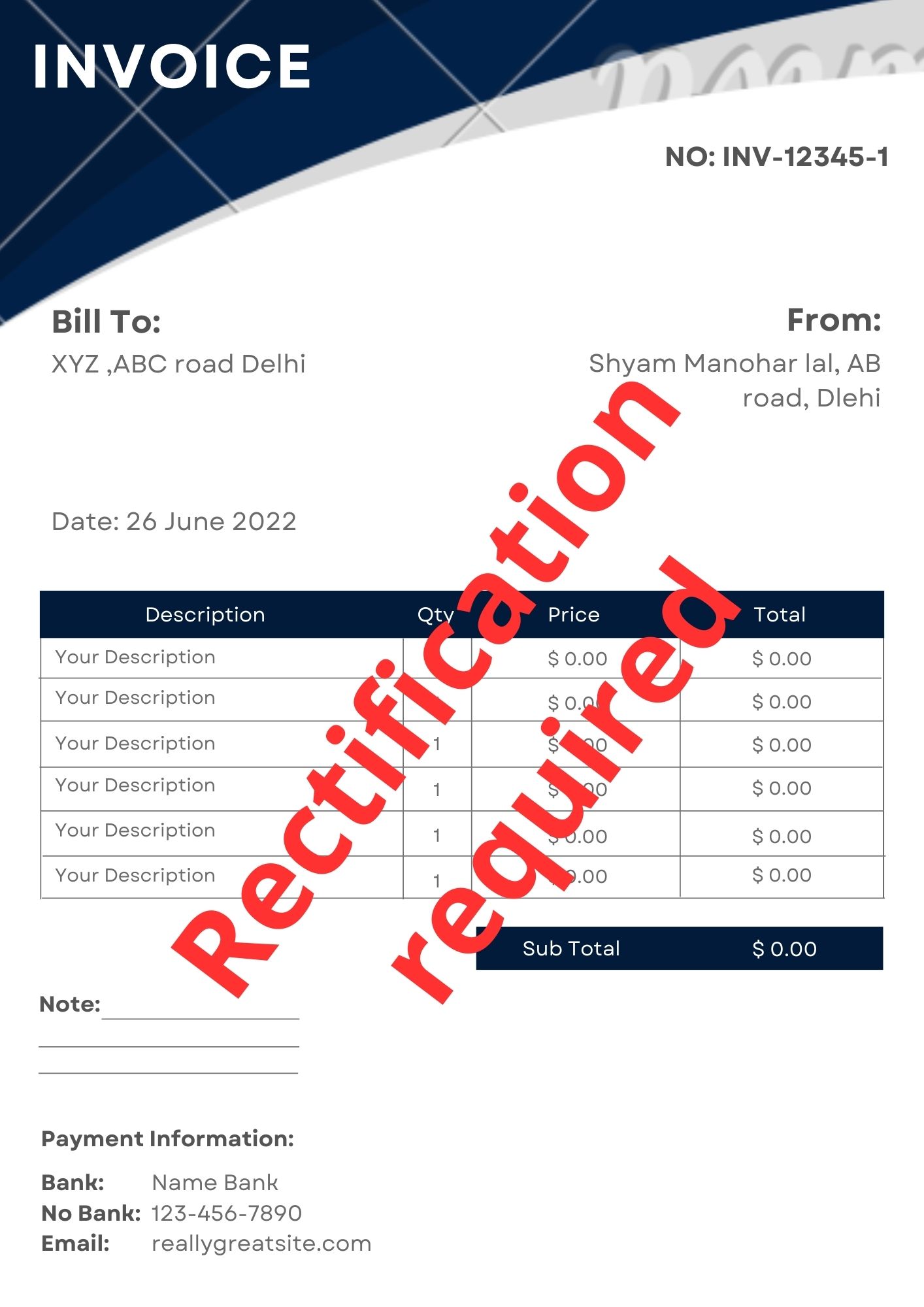

The petitioner filed a writ petition before the Hon’ble Orissa High Court seeking permission to rectify the GST Return filed for the period September, 2017 and March 2018 in Form-B2B instead of B2C as was wrongly filed under GSTR-1 in order to get the Input Tax Credit (ITC) benefit by the buyer. Such error was noticed when the due date by which the rectification should have been carried out was already passed.

Hon’ble High Court remarks that by permitting the Petitioner to rectify the above error, there will be no loss whatsoever caused to the opposite parties. HC also remarks that there will not be any escapement of tax. Further, Hon’ble HC opines that this is only about the ITC benefit which in any event has to be given to the Petitioner. On the contrary, if it is not permitted, then the Petitioner will unnecessarily be prejudiced

Held:

Rectification of form GSTR 1 was permitted by the Hon’ble Orissa High court following the decision of the Hon’ble Madras High Court in Writ Petition No.29676 of 2019 (M/s. SUN DYE CHEM v. The Assistant Commissioner ST). Further, direction was given to the department to receive the rectification manually. It was also directed that once the corrected Forms are received manually, the Department will facilitate the uploading of those details in the web portal.

Article written by CA. Ankit Karanpuria – feedback if any can be send to ankit.karanpuria@aasklegal.com

click herein below to download the notification

TS-79-HCORI-2023-GST-Shiva_Jyoti_Construction_idt

Disclaimer:

The information provided in this update is intended for informational purposes only and does not constitute legal opinion or advice. Readers are requested to seek formal legal advice prior to acting upon any of the information provided herein. This update is not intended to address the circumstances of any particular individual or corporate body. There can be no assurance that the judicial/ quasi judicial authorities may not take a position contrary to the views mentioned hereinrra quis.