Amount deposited in E-cash ledger prior to due date of filing of GST returns does not amounts to discharge of tax liability: Jharkhand High Court

Facts of the case

M/s RSB Transmissions (India) Limited had filed a writ petition before Hon’ble Jharkhand High court posing a question for adjudication that whether under the provisions of the GST Act, the amount deposited as tax through valid challans by a registered person in the government exchequer prior to due date of filing of the form GSTR 3B could be treated as discharge of tax liability due for the period in question in respect of which the form GSTR 3B was filed later and whether interest could be levied on delayed filing of form GSTR 3B in such circumstances under Section 50 of the CGST Act.

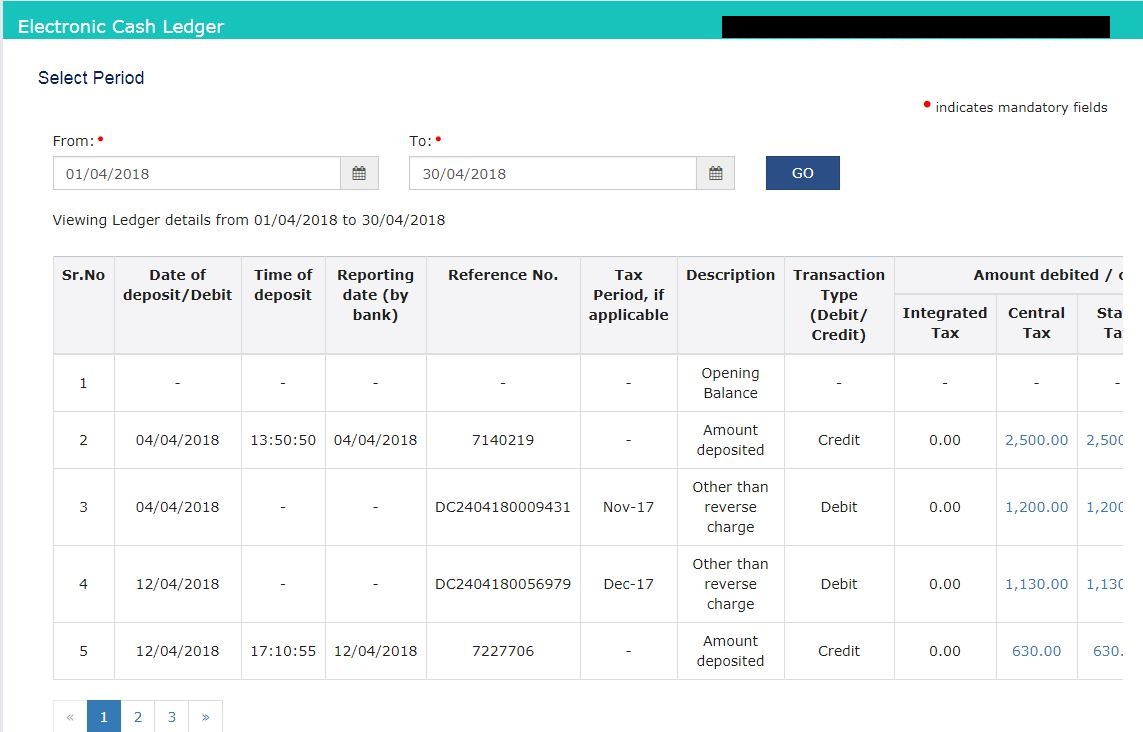

The petitioner deposited some amount in electronic cash ledger prior to due date of filing of form GSTR 3B and later filed form GSTR 3B after the due date. The petitioner further deposited remaining amount of cash in E-cash ledger which was required to discharge tax entire tax liability at the time of filing form GSTR 3B. Further, the Appellant also paid interest on such amount which was additionally deposited in E-cash ledger after the due date of filing of return and which was debited at the time of filing form GSTR 3B. However, the department demanded the interest on entire amount of liability paid in cash by way of debit in E-cash ledger for the period for which the form GSTR 3B was belatedly filed.

The petitioner contended that the interest could be leviable only on that part of the tax debited from the Electronic Cash ledger after the due date of filing of GSTR 3B returns. The primary contention of the petitioner was that the interest cannot be levied upon delayed filing of return but only on delayed payment of tax. Relying upon the proviso to Section 50 (1), it was contended that since the Electronic Cash Ledger is debited only at the time of filing of GSTR 3B return, levy of interest on the entire amount of tax paid through cash upon belated filing of GSTR 3B return cannot be sustained because amounts towards tax already lies with the Government exchequer much prior to the filing of GSTR 3B return. The debit entry is only a fictional entry which does not postulate any further movement of money.

The respondent contended that the amounts deposited prior to filing of GSTR-3B returns by the petitioner taxpayer in the E-Cash Ledger and credited in E-Credit Ledger, though reflected in the E-Cash Ledger, were debited to the Government coffer after filing of GSTR-3B returns for the said tax period i.e. after some delay. Thus, interest under Section 50 became automatic on net cash tax liability. The payment of tax by the normal taxpayer is by 20th day of the succeeding month. Further, it was contended by the respondents that the Cash payments, if any, required to be paid, is first deposited in the Cash Ledger and the taxpayer shall debit the ledger while making payment in the monthly returns and the relevant debit entry number is reflected on his / her ledger after filing relevant return.

Decision of the Hon’ble High Court

Hon’ble High court on perusal of Section 49(1) of the CGST Act remarks that any deposit made in the modes prescribed under Section 49(1) are mere deposits towards tax, interest, penalty, fee or any other amount by such person which can be credited to the Electronic Cash Ledger. Hon’ble HC further remarks that on a combined reading of Section 49(1) of CGST Act, 2017 and Rule 87 (6) and (7) of CGST Rules, 2017 both go to show that such deposit does not mean that the amount is appropriated towards the Government exchequer. Tax liability gets discharged only upon filing of GSTR 3B return, the last date of which is 20th of the succeeding month on which the tax is due and even though GSTR-3B return can be filed prior to the last date and such tax liability can be discharged on its filing, but mere deposit of amount in the Electronic Cash Ledger on any date prior to filing of GSTR-3B return, does not amount to payment of tax due to its State exchequer.

HC observed that the discharge of tax liability is simultaneous with the filing of GSTR 3B return under the scheme of GST regime and the provisions of GST Act intended to ensure seamless flow of movement of goods and services and payment of tax by the registered persons in the form prescribed through a digital mode maintained by GSTIN. It was also observed that there is no time prescribed for deposit of cash in the Cash Ledger. It, in fact, is just an e-wallet where cash can be deposited at any time by creating the requisite Challans. Since, the amount lies deposited in the E-Cash Ledger, a registered assesse can claim its refund any time, following the procedure prescribed under the Act and the Rules. Of course, while making refund from the Electronic Cash Ledger, the proper officer has to satisfy whether any outstanding tax liability remains to be discharged by the person concerned.

It was observed that the computation of interest liability is dependent upon the delay in filing of returns beyond the due date. The tax payer can claim refund under Section 54 of CGST Act at any point of time in accordance with the provisions of the Act. There is a distinction, so far as ITC available in the Electronic Credit Ledger and Electronic Cash Ledger is concerned. As such cash is just in the nature of deposit in the Electronic Cash Ledger, whereas the ITC is available in favour of the assessee on account of tax already paid. Therefore, certain distinction has been made under Section 50 of CGST Act as regards the computation of interest only on that portion of the tax paid after due date of filing of return under Section 39(7) of the Act by debiting the Electronic Cash Ledger.

Hon’ble HC finally holds that the liability to pay interest arises on delayed filing of GSTR-3B return and debit of tax due from the Electronic Cash Ledger. Any deposit in the Electronic Cash Ledger prior to the due date of filing of GSTR 3B return does not amount to discharge of tax liability on the part of the registered person.

[TS-589-HC(JHAR)-2022-GST].

click herein below to download the judgement

TS-589-HCJHAR-2022-GST-RSB_Transmissions__India__Limited (1)

Article written by CA. Ankit Karanpuria – feedback if any can be send to ankit.karanpuria@aasklegal.com

Disclaimer:

The information provided in this update is intended for informational purposes only and does not constitute legal opinion or advice. Readers are requested to seek formal legal advice prior to acting upon any of the information provided herein. This update is not intended to address the circumstances of any particular individual or corporate body. There can be no assurance that the judicial/ quasi judicial authorities may not take a position contrary to the views mentioned hereinrra quis.