By aasklegal

By aasklegal

|

Nov 29, 2022

Nov 29, 2022

Initiation of proceedings u/s 73 of the CGST Act for recovery of CENVAT credit carried forwarded in form Tran-1 is beyond the jurisdiction of the proper officer; Authorities can initiate proceedings under erstwhile regime laws: Jharkhand HC

The petitioner M/s Usha Martin Limited filed a writ petition before Hon’ble Jharkhand High Court against the order of jurisdictional […]

By aasklegal

By aasklegal

|

Nov 24, 2022

Nov 24, 2022

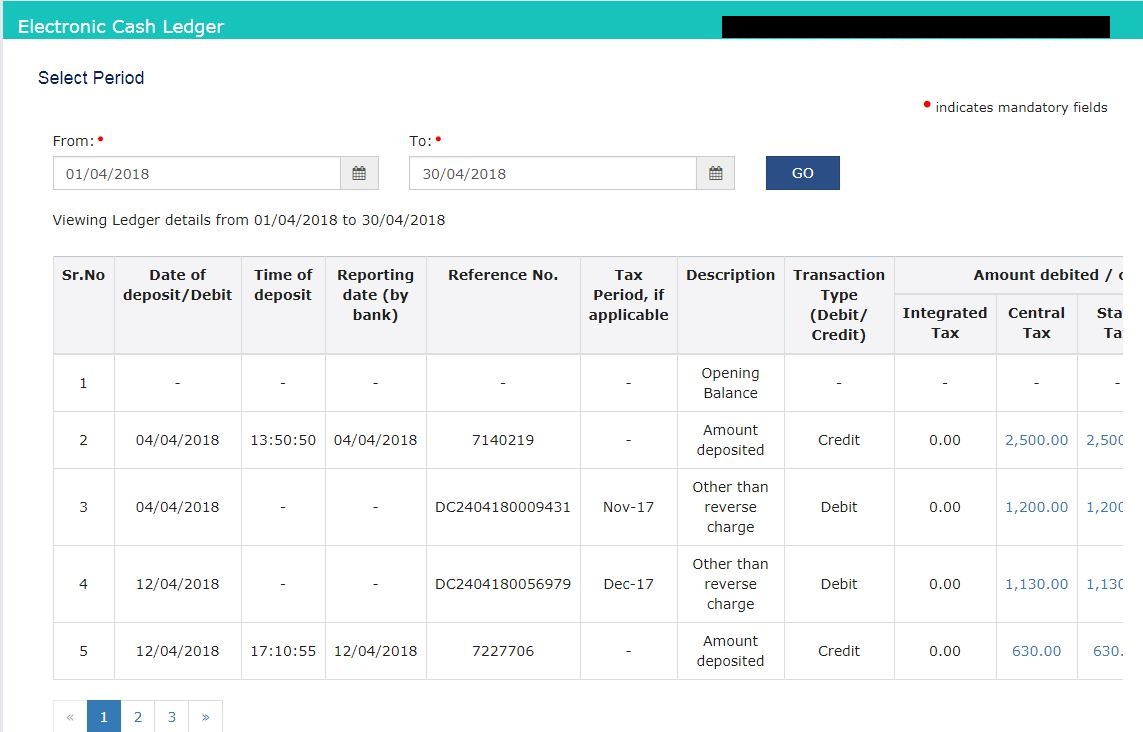

Amount deposited in E-cash ledger prior to due date of filing of GST returns does not amounts to discharge of tax liability: Jharkhand High Court

Facts of the case M/s RSB Transmissions (India) Limited had filed a writ petition before Hon’ble Jharkhand High court posing […]

By aasklegal

By aasklegal

|

Nov 15, 2022

Nov 15, 2022

Apex Court allows the carry forward of transitional credit; directs re-opening of GSTN portal for filing Form TRAN-1 and TRAN-2

Hon’ble SC in case of Union of India vs Filco Trade Center Private Limited [TS-369-SC-2022-GST] provides a big relief to the […]